Corporate Venture Capital: Key Insights from the Frontlines

by Nicolas Sauvage

Published: 10/15/2024

Navigating the Future of Corporate Venturing

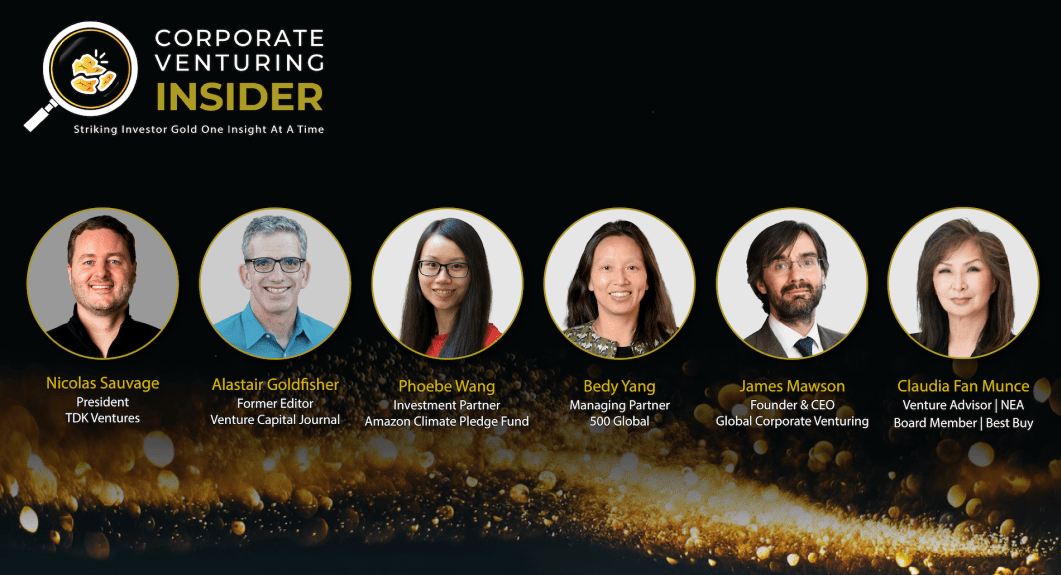

This summer, I had the privilege of hosting a webinar that brought together some of the brightest minds in corporate venture capital (CVC). We explored not just the current landscape but also the future trajectory of CVC, delving into how our industry is evolving to shape markets, create new opportunities, and drive innovation.

This event was more than a discussion; it was a deep reflection on the rapid growth of CVCs and their pivotal role in industry transformation. The webinar also marked the launch of Corporate Venturing Insider (cv-insider.com), a platform launched to foster knowledge-sharing, collaboration, and innovation across the corporate venturing ecosystem, creating a dynamic space for exchanging ideas, forming partnerships, and sharing best practices.

Growth and Impact

James Mawson, founder of Global Corporate Venturing, emphasized the remarkable growth in the CVC sector, noting a tenfold increase in the number of CVCs over the past 15 years. He pointed out that corporations with active CVC arms generally outperform their peers, benefiting from higher share prices and greater value creation. However, Mawson also cautioned that newer CVCs without established track records face challenges. Yet, there’s optimism for continued growth if these emerging players can learn from the experiences of seasoned CVCs.

Reputation and Decision-Making

The discussion then shifted to the operational side of CVCs, particularly the importance of reputation and the speed of decision-making. Bedy Yang, Managing Partner at 500 Global, highlighted that a CVC’s reputation is closely tied to how quickly its investment committee can make decisions.

"How quickly your investment committee can make decisions greatly affects your reputation among founders," she noted. This underscores the delicate balance CVCs must maintain between delivering financial returns and aligning strategically with their parent companies.

Indeed, CVCs must navigate the dual priorities of delivering financial returns and maintaining strategic alignment with their parent companies.

With reputation and decision-making at the forefront, the speakers also explored how strategic alignment, and the use of platform teams can further improve the effectiveness of CVCs.

The Role of Platform Teams

A significant part of the discussion centered on the expanding role of platform teams within CVCs. These teams are instrumental in connecting startups with critical resources and opportunities, including within their corporate parent organizations.

Platform teams can help entrepreneurs access critical guidance, resources, markets, and customers they wouldn’t reach otherwise. This is a unique value that CVCs can bring to their portfolio companies, extending far beyond money.

Patience emerged as a critical virtue in the corporate venturing process. As we often hear, “It takes 10 years to achieve overnight success.” Effectively conveying this long-term perspective to corporate stakeholders is essential for ensuring that CVCs remain aligned with their parent companies' strategic goals.

Driving Innovation and Long-Term Strategy

The conversation further explored the critical role CVCs play in driving innovation and long-term corporate strategy. Claudia Fan Munce, Board Member at NEA, emphasized the increasing influence of CVCs in shaping corporate strategies. "Corporate technologists and innovators are now putting their money where their mouth is, making real investments in what was previously theoretical," she said, highlighting the tangible impact CVCs are making in the innovation landscape.

Scalability and Balance

The discussion then addressed the challenges of scalability and maintaining a balance between corporate responsibilities and supporting startups. Phoebe Wang from Amazon's Climate Pledge Fund shared insights on the importance of scaling from day one and balancing the needs of both the corporate entity and the startups. "CVCs bring a wealth of experience, helping startups scale rapidly from zero to one," she explained, reinforcing the idea that serving both the corporate parent, and startups effectively is crucial for maintaining a strong reputation.

The Path Forward

The gathering of CVC professionals underscored the vital role of community and collaboration in the future of CVCs—leveraging our ability to support Impact Scaling entrepreneurs as we strategically align with corporate goals.

The webinar made it clear: the future of CVCs lies in community and collaboration, leveraging our collective strength to support impact-scaling entrepreneurs while strategically aligning with corporate goals. As the industry continues to evolve, CVCs must not only adapt and innovate but also leverage their unique positions to drive sustainable, long-term success. This is precisely why we launched Corporate Venturing Insider—because we believe in the power of shared knowledge and collaboration. We invite you to join us on this journey, unlocking new possibilities and propelling innovation forward.

There are 2,500 CVCs around the world, a 10x from 15 years ago. We will likely see another 10x increase in the next 15 years if this generation is successful.

There are 2,500 CVCs around the world, a 10x from 15 years ago. We will likely see another 10x increase in the next 15 years if this generation is successful.